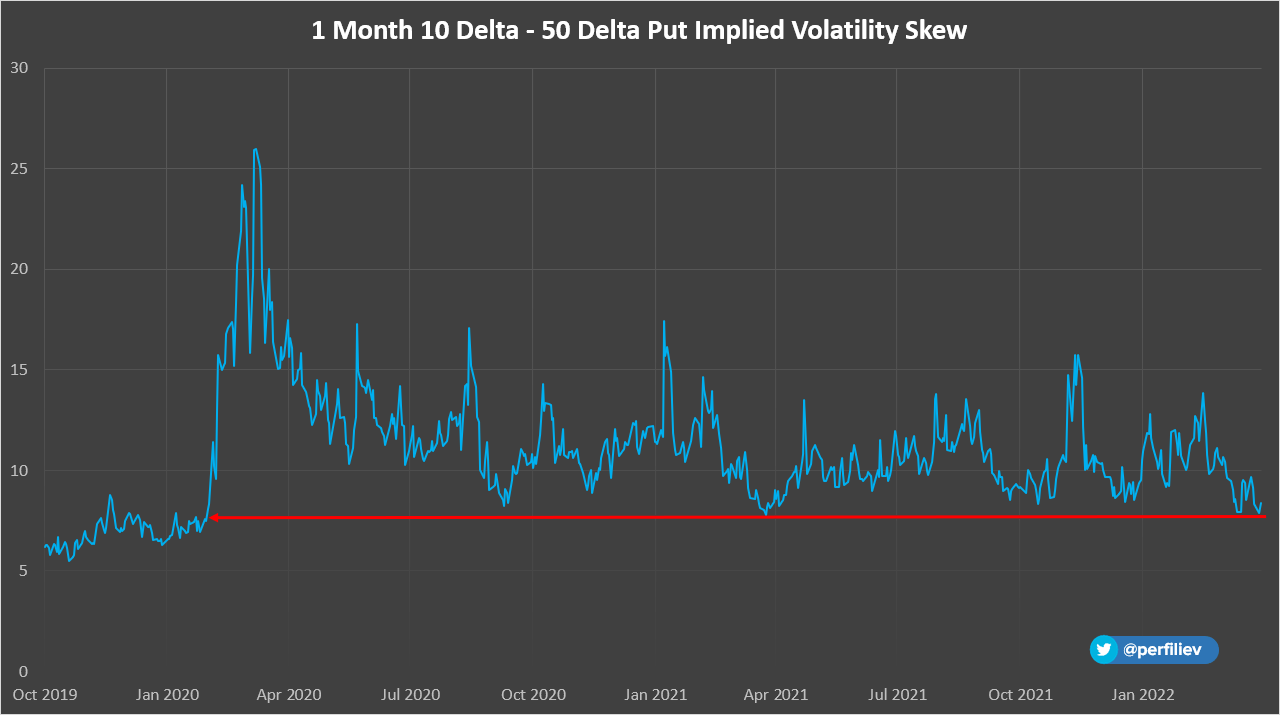

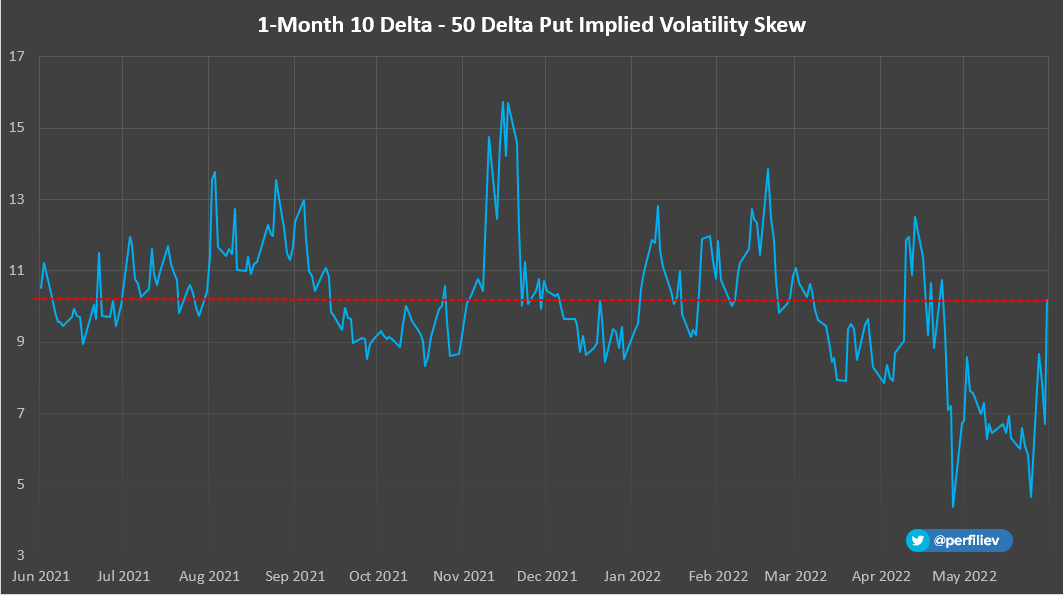

Skew has been flattish for some time this year, despite a decline.

Since the year started, the sentiment was bearish and market participants were overly hedged. As the market declined - implied vol went up, but it still underperformed, given the magnitude of the moves.

Today 👀 a spike in short dated🔺-sticky skew. This is the 1st 🕰 we’ve 👀 this since secular 📉began & it hints @ a potentially critical change in dealer positioning & the distribution of underlying outcomes. We’re transitioning to a fat left tail, right biased distribution…⚠️

— Cem Karsan 🥐 (@jam_croissant) June 17, 2022

Positioning and underperformance resulted in a suppression of vol due to:

• Put monetization - the market was closing or rolling hedges.

• Selling vol to take advantage of higher absolute vol levels.

• Just not buying puts on down moves, because everyone's already hedged.

As a result, dealers were supplied with vol. This vol supply made it more difficult to see a substantial vol event so far.

Puts underperform ➡️ they get closed ➡️ dealers buyback delta hedges ➡️ vol decreases ➡️ vanna and charm cause more delta buybacks from dealers.

This was noted by many this year, as FinTwit discussed a low $VIX and its dislocation against the bond volatility $MOVE index earlier.

Skew also underperformed as OTM puts were not bid on market declines. I've noted this in my commentary from 21 April 2022:

But yesterday, we finally saw delta-sticky skew catch a bid and steepen into the decline. Higher skew implies a fatter left tail and a higher chance of higher levels of implied vol in a further sell-off.

It's worth watching as it might indicate a change in positioning. If skew steepens further and vol becomes in short supply, dealers won't be providing supportive flows and might exacerbate the moves instead.

Fixed strike vol was also up yesterday, indicating that vol outperformed relative to expectations 👀

TL;DR, skew is not overly high, but it's worth watching whether the market is now catching investors off guard, as they reprice those left-tail outcomes and rush for protection during sell-offs. Or whether it's just a one-off going into the summer... 🏖️

As always, thank you for reading! For more posts, you can also follow me on Twitter.

Let's keep in touch! 🙂