Quite an eventful day today.

First, it's interesting to see a -0.4% down move in $SPX accompanied by a lower $VIX. Historically, it's not often that $VIX loses 2 pts on a half-percent sell-off in $SPX.

It still sits >30, implying daily 2% moves in $SPX. If $SPX realizes anything less than that, it should pull $VIX lower from its elevated levels.

Usually, this spot-down-vol-down dynamic implies little demand for put protection. This is understandable given both how the year started (inflation & QT) and how it's going (war).

Hence, the sell-off this week didn't take anyone by surprise - the market was prepared and bought puts long ago. Maybe even over-prepared, such that a -1.5% intraday move today was a non-event for the $VIX.

And the market has every reason to be concerned.

There are very strong headwinds for $SPX long term:

• Strong dollar, hurting exports

• High commod prices feeding into costs and squeezing margins

• Russia is closed for business - lower earnings for exposed companies

• Putin threatens to nuke everyone

• Fed tightening

The Fed, in particular, finds itself in a very tricky place now.

According to JPow, the economy wasn't strong enough to handle a 0.25% rate hike just a year ago. So he waited for the highest inflation in 40 years, surging commod prices, and a war in Europe.

Seems like a great time to remove accommodation.

"Hey, job market! Deal with it. Sorry not sorry."

Unlucky for the Fed.

It's one thing that inflation didn't turn out to be transitory due to supply-chain issues. And it's another to have rising commodity prices further messing with you.

The February CPI came in at 7.9% today, which excludes the impact of higher energy prices from March. But whatever the cause of inflation, the Fed has only one medicine.

The market is pricing a 0.25% hike next Wednesday and expects at least 6.5 hikes this year. Almost one for every remaining meeting this year.

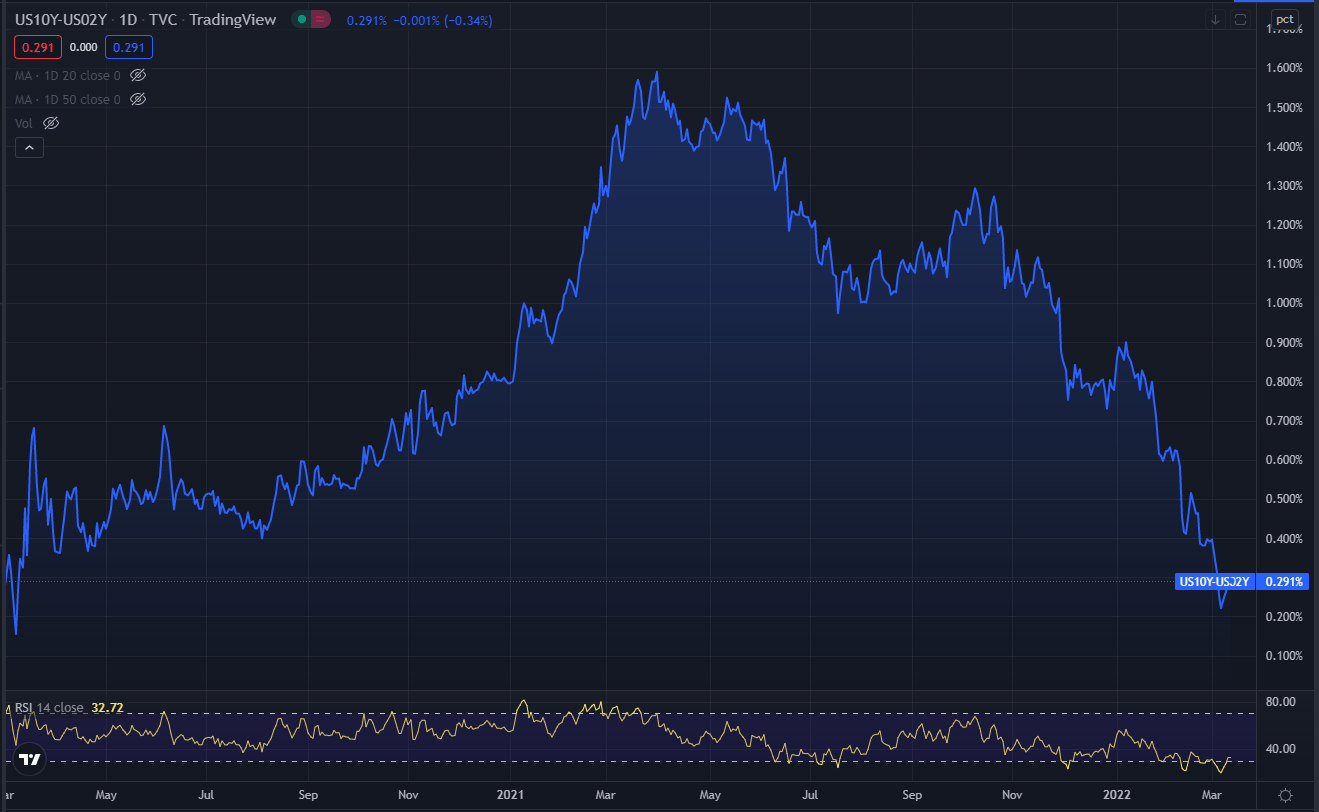

And let's not forget the risk of yield curve inversion. 2s10s is off the lows today, yet trading at the lowest since March 2020.

Just 30 bps separates 10y and 2y. The short-term end of the yield curve certainly wants to be higher but is still anchored by the Fed. High chance that the first few rate hikes will send the curve into inversion.

Despite the risks, there's some short-term structural support from the options market.

Vols are elevated, and market participants are hedged. After Monday's $VIX spike to 36, $VIX has been falling this week.

ATM vols and fixed-strike vols are down.

Hedges underperform.

Vol underperforms too, as we’ve seen today. No one rushes to buy puts on a down move since the market is overhedged already. Down moves also don't get exacerbated by panic selling as investors have puts to limit the losses.

As the vol falls, puts will lose value, and some might get closed. Delta hedging will force options market makers to be buyers of the index. This is more pronounced since we approach OpEx next week.

For more, check Cem's excellent thread below:

1/x Theory: There is a growing phenomenon in Vol markets that I don’t believe has been documented. For lack of a better term, I’ll call it the ‘2nd event phenomenon.’ If a meaningful decline hasn’t happened for a while, the Vol reaction to a down move tends to outperform IV skew.

— Cem Karsan 🥐 (@jam_croissant) September 7, 2020

From the vol perspective, I think it still pays to be long gamma, given many catalysts and uncertainly ahead.

$SPX 20-day realized sits at 25% right now - roughly in line with implied.

In other news, there was an ECB meeting today and for macro interpretations of this, I would like to guide you to this insightful thread below:

Forward guidance is amongst the strongest tools a Central Bank has, and today the ECB made use of it.

— Alf (@MacroAlf) March 10, 2022

Rather than their actions, their change in communication was hugely important.

And it has implications for the Fed, too.

A thread.

As always, thank you for reading!

For more threads, you can also follow me on Twitter.

Let's keep in touch! 🙂