Is RRP drawdown the reason why stocks are up and the economy is strong despite tighter monetary policy?

What happens when RRP goes down to zero? 👇

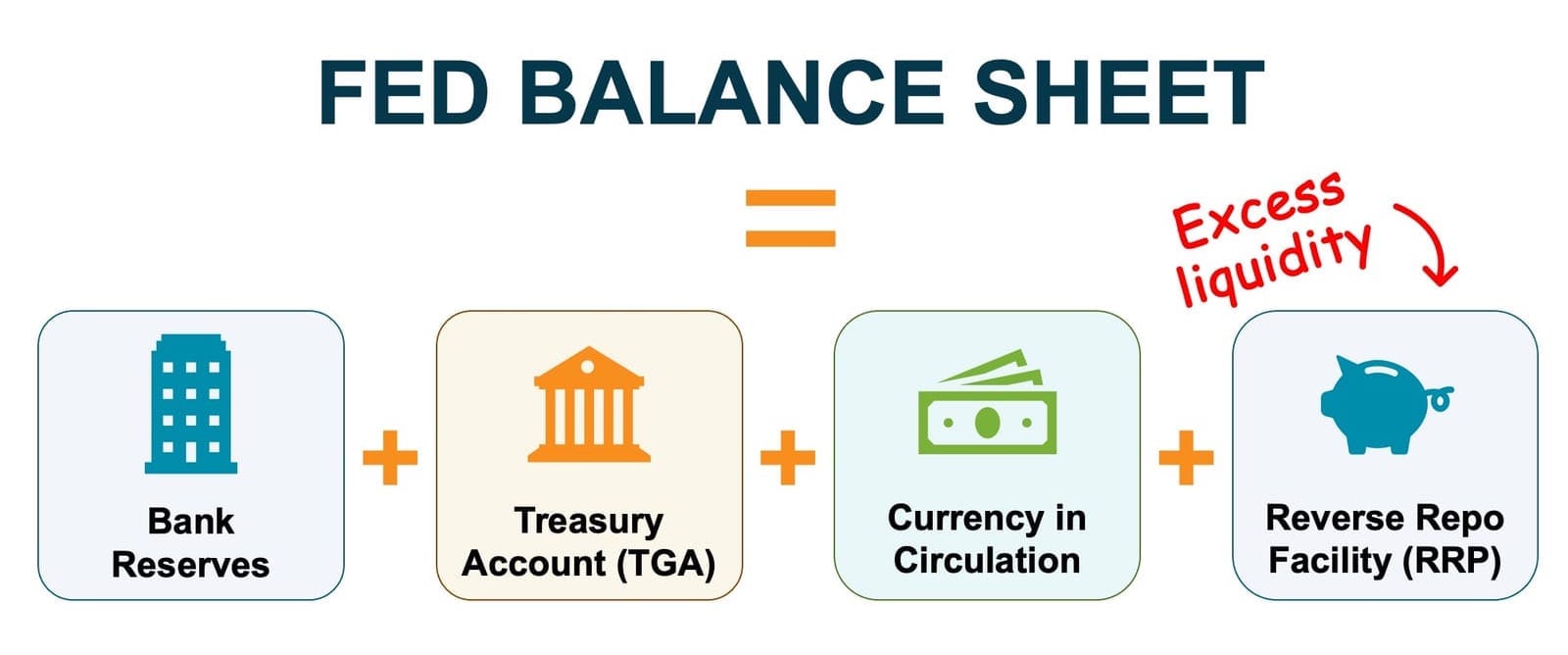

Fed's RRP facility is supposed to be a measure of "excess liquidity", which was needed during the QE era.

During Covid, QE was executed on such a scale that there was too much money in the system.

Fed calls it the "ample reserves" environment.

And yes, reserves were so "ample" that there weren't enough assets to buy, even despite Treasury's record issuance in 2020-21.

Any excess cash from banks and money market funds was parked at the Fed's RRP facility, preventing rates from going negative.

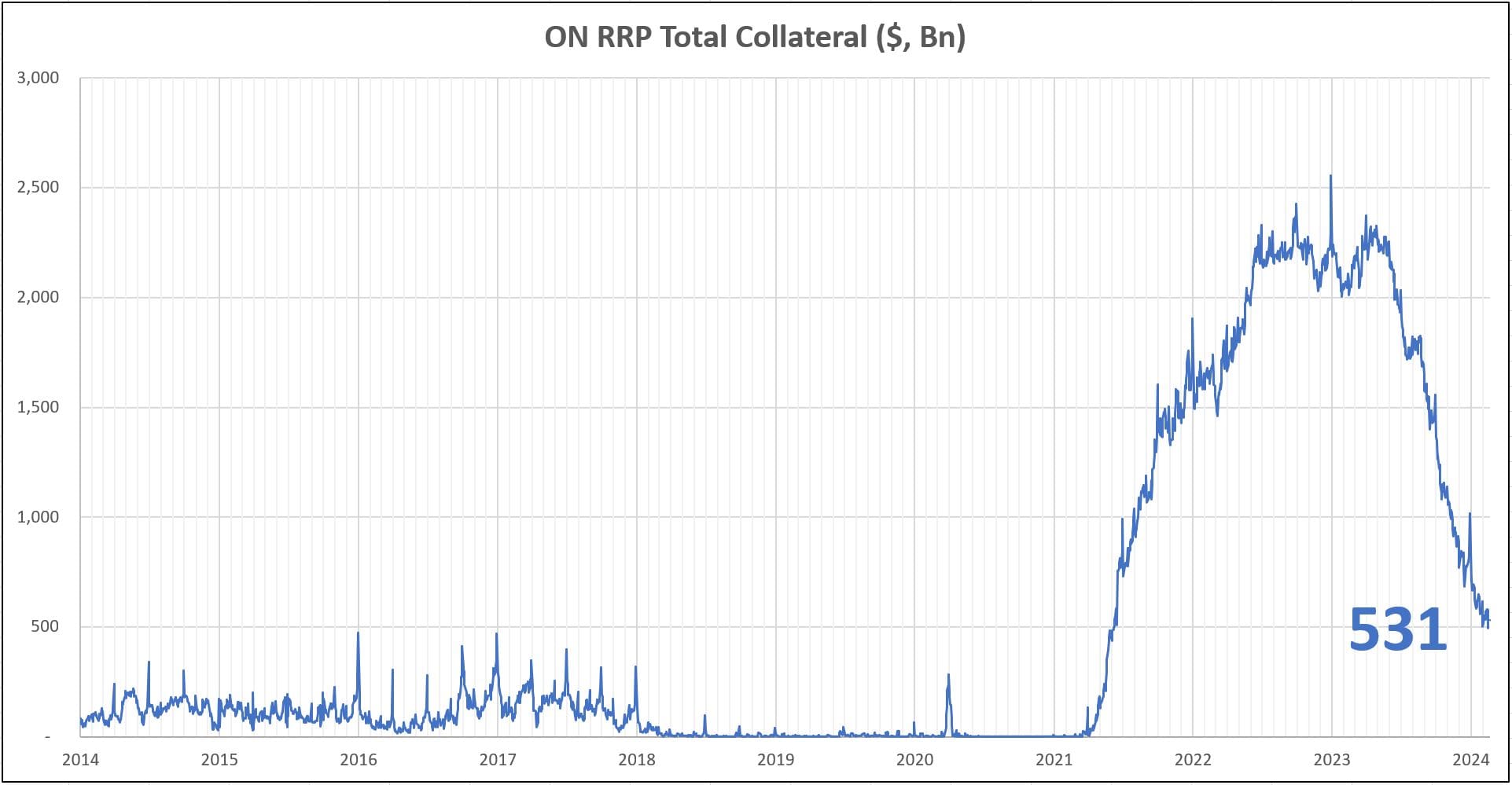

At its peak, the RRP facility reached $2.5T.

This money just sat at the Fed and did nothing.

Just dead money.

But it wasn't completely useless. It was a rainy day fund.

And one day, it started raining.

After a decade of ZIRP policy and an abundance of liquidity, the Fed hiked rates and began reducing the balance sheet (QT).

Everyone was patiently waiting for "something to break".

But apart from a few regional banks, things were going well - strong economy, tight jobs market, higher stock market.

Hell, even the Bitcoin was up.

How so?

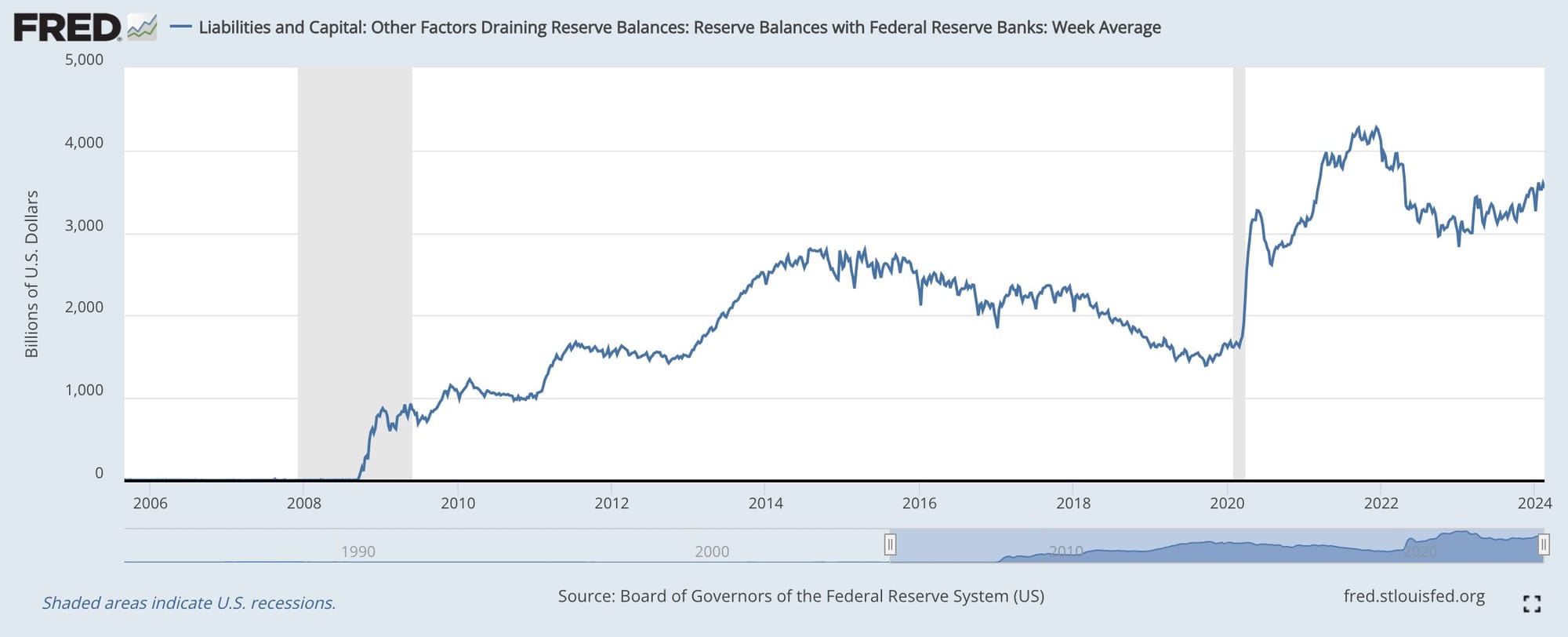

QT usually leads to lower bank reserves and lower liquidity, the same way as QE leads to higher bank reserves and more liquidity.

But what is this? Bank reserves were actually UP over last year?!

This is not what one would expect during QT.

When the Fed reduces its balance sheet, bank reserves are part of the equation, but not the full picture.

Because:

At the moment, the reduction in Fed balance sheet is coming at the expense of RRP.

With higher rates and QT, the money that was sitting unproductive at the Fed made its way back into the financial and banking system.

Over the last year, the Fed's ON RRP repo facility is down almost $2T, while the balance sheet is lower by $1.3T.

Not only did the RRP drawdown offset the impact of Fed's balance sheet reduction, but one could also argue that it was simulative and a net positive for banks' reserves, the economy, and the markets.

And, to the surprise of everyone, the financial system didn't collapse.

It's difficult to experience a shortage of liquidity when $2T was added to the system over one year.

The US economy handled 5% rates and QT very well, but it seems it's just running on fumes from the QE era.

The 2020-21 liquidity injection was so high that it kept us going another few years even after the Fed policy was reversed.

Right now the RRP balance stands at around $500Bn.

At the current pace, it should be depleted sometime in late summer 2024.

What happens then?

With no RRP to cushion the blow, the financial system might (finally) feel the full wrath of the Fed's tighter policy.

If Fed continues with QT, its balance sheet will be reduced at the expense of lower bank reserves.

Potentially this might lead to a situation when there won't be enough liquidity to absorb all the assets, including treasuries.

This is where things get interesting.

The Fed needs to ensure the stability of the Treasury market regardless of where inflation is at the time.

If there's no spare cash in the system to buy all the bonds, the Fed will have to step in and inject much-needed liquidity into a starved market, similar to what they did during the 2019 repo spike.

I.e. another round of QE (or a variation thereof).

A true pivot, simply to keep the system afloat.