What does the options market say about the stock market?

Despite the negative sentiment and risks, investors don't seem to put their money where their mouth is. Due to little demand, hedges are screening cheap, and vol sellers are coming back.

Here's what I'm looking at 👇

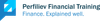

Market isn't expecting tail events into the next month. SPX 1-month put skew, as measured by the difference between 10 delta and ATM puts, is near the lowest levels in the post-pandemic world. Currently sits in lowest 3%-percentile.

This implies that deep OTM puts are trading cheaper than usual.

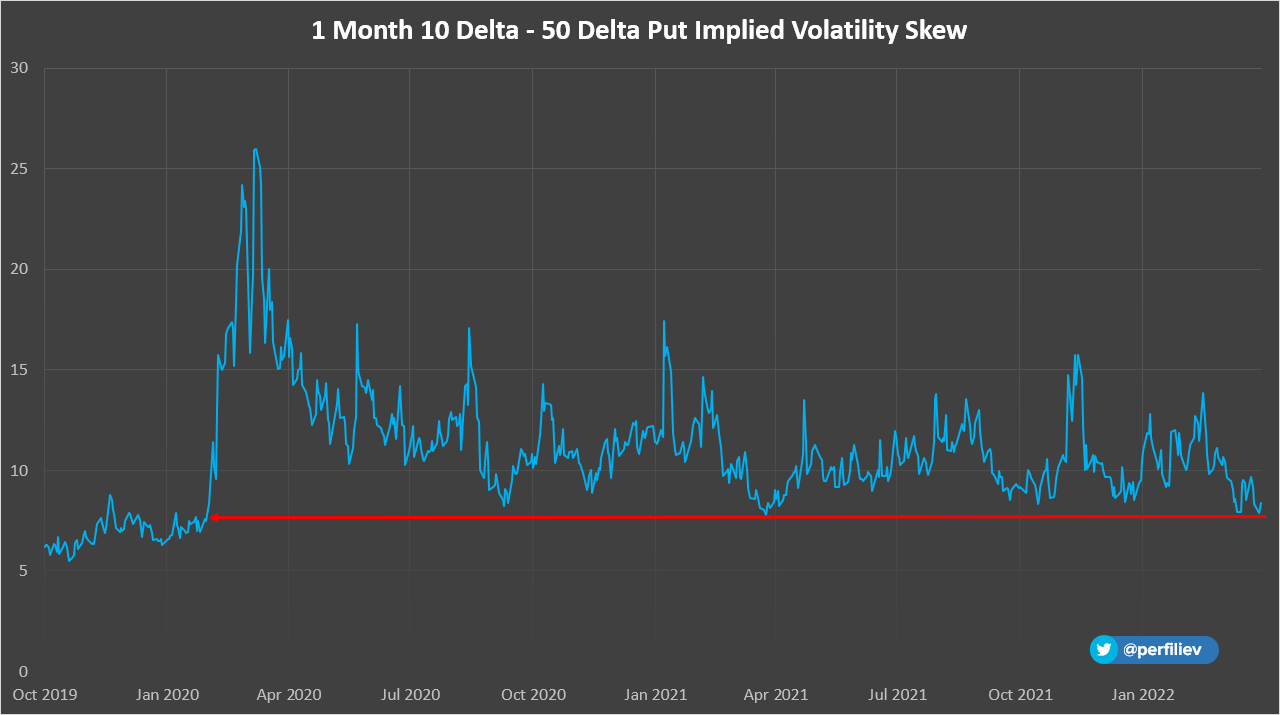

It can also be seen in the TDEX index, which shows a price of a standardized 1-month deep OTM put option. It's trading at the lowest level in 1.5 years!

The buyers of such an option hedge against a sharp sell-off that will make their OTM put profitable. Given the global risks and the macroeconomic backdrop, I would've expected the index to be a bit higher, to be honest. Yet, there isn't enough demand to push the price up.

This is quite interesting, especially given the catalysts over the next month. A 1-month expiration, for example, spans a large portion of the earnings season with potential Netflix-type scenarios. It also includes a Fed meeting, jobs report, CPI for April and other data.

So either the market expects the bearish scenarios/risks to play out gradually, instead of a sharp "tail event" drop... or not at all... And if there's put buying and hedging right now - it's not in the far wings of 10 delta puts.

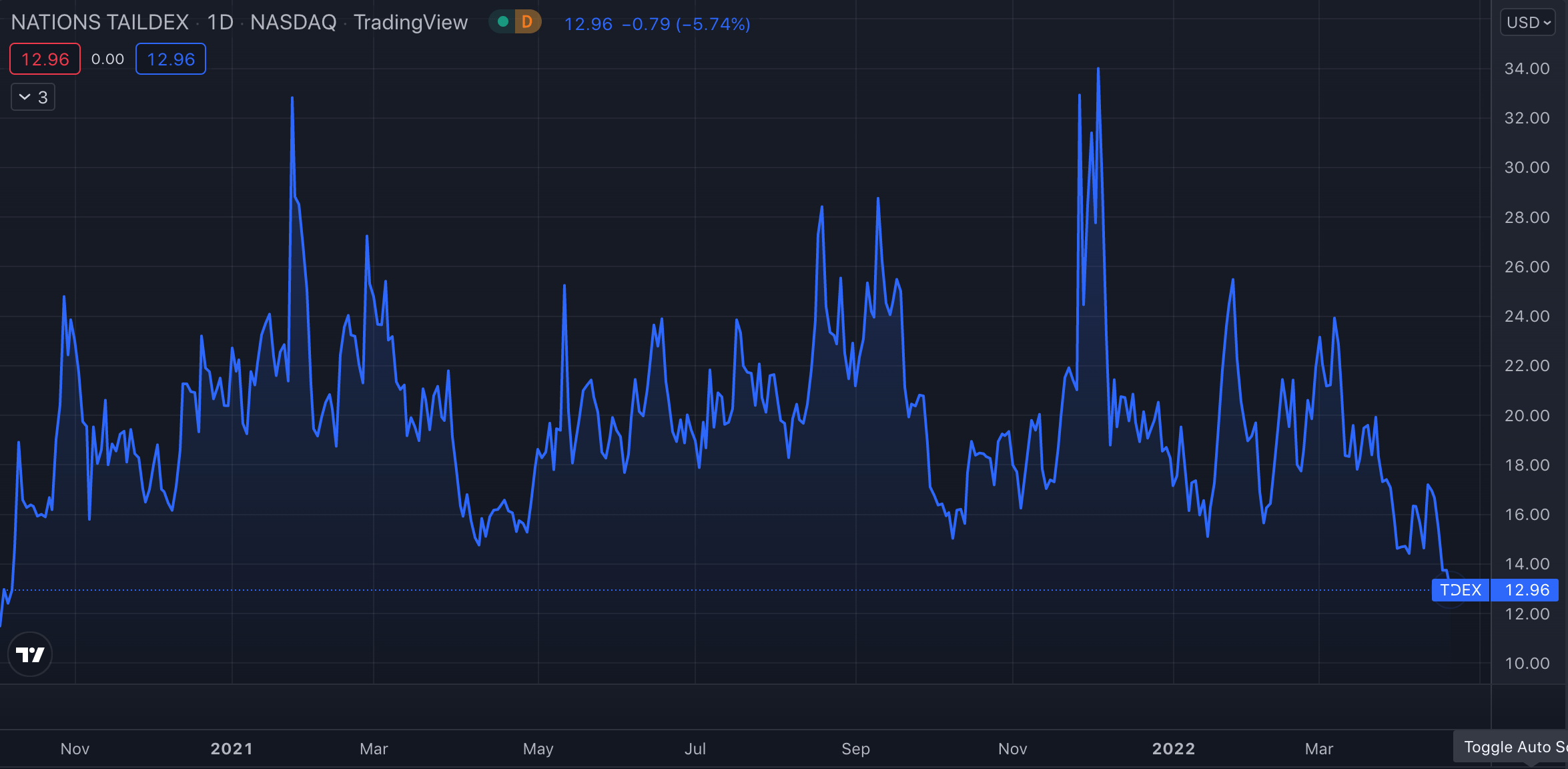

There was also no panic when SPX sold off -2.1% last week. SPX skew underrealized, meaning volatility didn't rise on the market sell-off as much as implied by the options skew. The fixed-strike put vols actually decreased, whereas fixed-strike call vols increased.

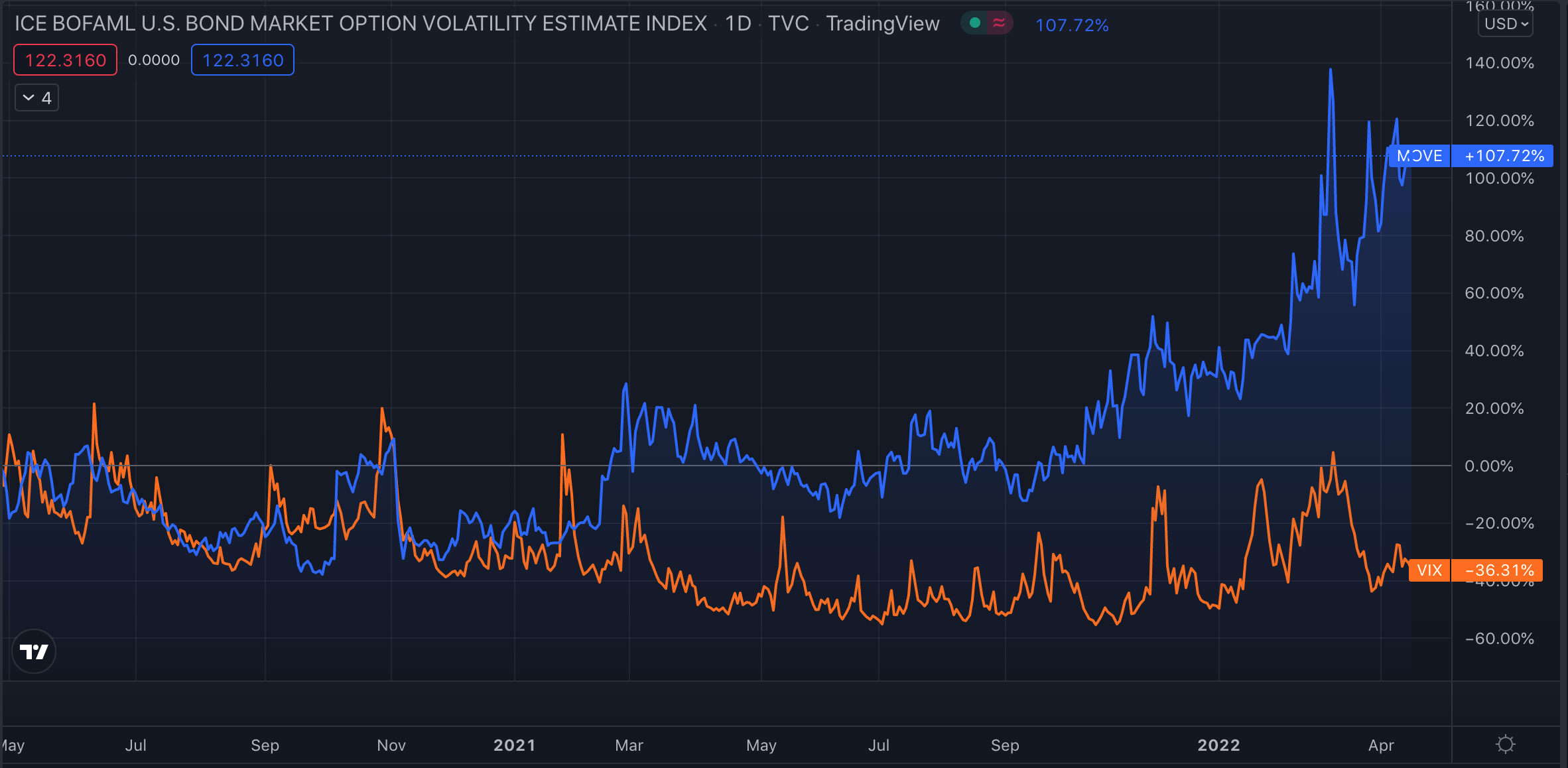

This chart has been doing rounds showing dislocation between SPX implied vol (VIX) and bonds implied vol (MOVE). USTs sold off sharply this year, which is reflected in higher implied vol. SPX is -6.4% YTD, but VIX is about to jump under 20 any minute now.

It can also signify that systematic vol sellers are becoming more comfortable getting back to the market. At least the VIX term structure is welcoming as contango further steepened in April.

Puts bought/sold ratio sitting near lows:

— SqueezeMetrics (@SqueezeMetrics) April 19, 2022

All-in-all, there seems to be less short term uncertainty. The market doesn't look concerned with unknown unknowns and the known unknowns it deems manageable.

Yet, please, keep in mind that such a setup can also be a sign of fragility.

Why is that?

Any external shock that sends the index lower will catch investors unprepared. As they buy puts, the dealers will further sell the index to delta hedge, making matters worse. We're also sitting at the gamma flip point with a higher-volatility region below.

As always, thank you for reading! For more posts, you can also follow me on Twitter.

Let's keep in touch! 🙂