What is the Basis Trade?

It's an arbitrage trade aiming to profit from the price difference between a bond and its futures contract.

"Basis" means "a spread".

For instance, if a futures is trading at a higher price ($99) than a cash bond ($98.50), the trade is:

- Short the Treasury futures at $99

- Buy a Treasury bond at $98.50

Hedge funds need leverage to make meaningful profit, so they borrow money to buy the bond for the trade.

To borrow money in the repo market they pledge the same Treasury bond as collateral for the loan and have to pay a repo rate.

The basis trade locks in a profit once prices converge as the futures approaches expiry.

Why does it blow up?

If Treasury bond prices fall

⬇️

Loan collateral value shrinks

⬇️

Margin call

⬇️

Need to post more collateral or close the trade

Unwinding the trade means the hedge fund needs to sell cash bonds/buy futures back, driving bond prices lower.

This kickstarts a feedback loop.

As bond prices fall further, more funds may be forced to close the trade, if they struggle to post more collateral.

To keep the trade alive, it's important to have access to repo funding, which usually dries up during market stress.

Where can you see this?

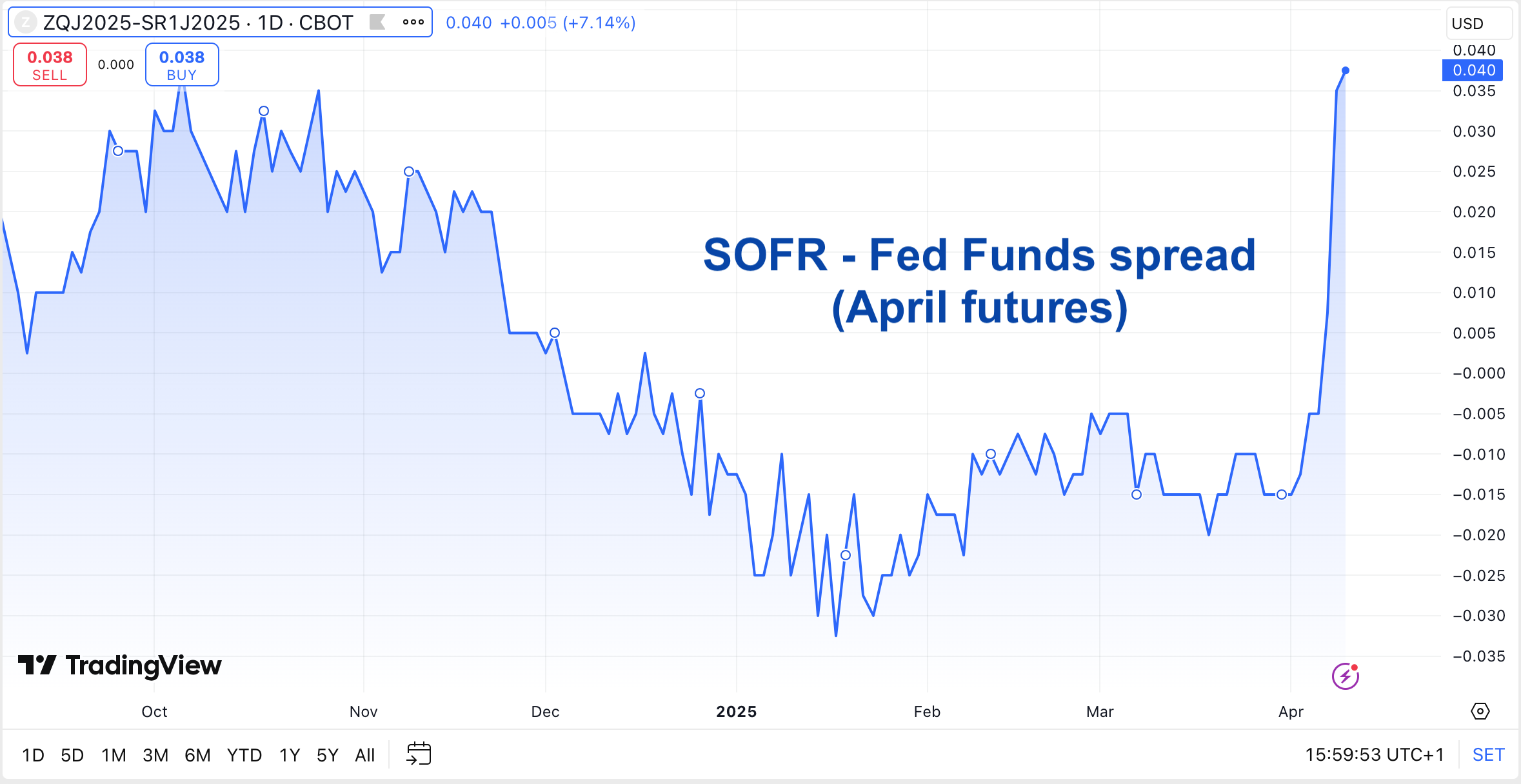

For example, you can track the spread between SOFR rate and Fed Funds rate.

- SORF rate represents a secured (collateralized) borrowing (i.e. repo).

- Fed Funds is the unsecured borrowing.

Usually, SOFR < FF rate since collateralized borrowing should be safer and more secure.

However, when the repo market financing tightens, the SORF rate can be higher than Fed Funds.

I.e. it's more expensive to borrow on a collateralized basis than not!

This is what we're seeing now, as shown in the chart below 👇

(This is SR1J2025-ZQJ2025 on TradingView)