"Keep calm and carry on." - that's the motto of this market right now.

+0.81% on the SPX today, and the risk-on is in full swing this spring. Flashbacks of 2021 are all over the place - tech, growth and crypto are all higher in the last few weeks.

Even though only half of S&P 500 stocks went up today, the ones that did are the ones that count: $AAPL, $TSLA, $AMZN, $MSFT and the rest of the crew.

The stock-split card is working for $TSLA, which added another 5% today and climbed back above $1,100.

The "unprofitable tech" fund $ARKK is also back in the game - up 34% since the dreaded Fed meeting just a few weeks ago in mid-March.

And there aren't many signs of panic.

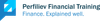

CDS indices like CDX IG and iTraxx have been drifting lower since March, along with the credit spreads that started narrowing around the same time.

Yes, in the face of tightening financial conditions. If you bought corporate bonds via $LQD and $HYG just before the Fed hike in March, you would be up 2.59% and 3.25%, respectively.

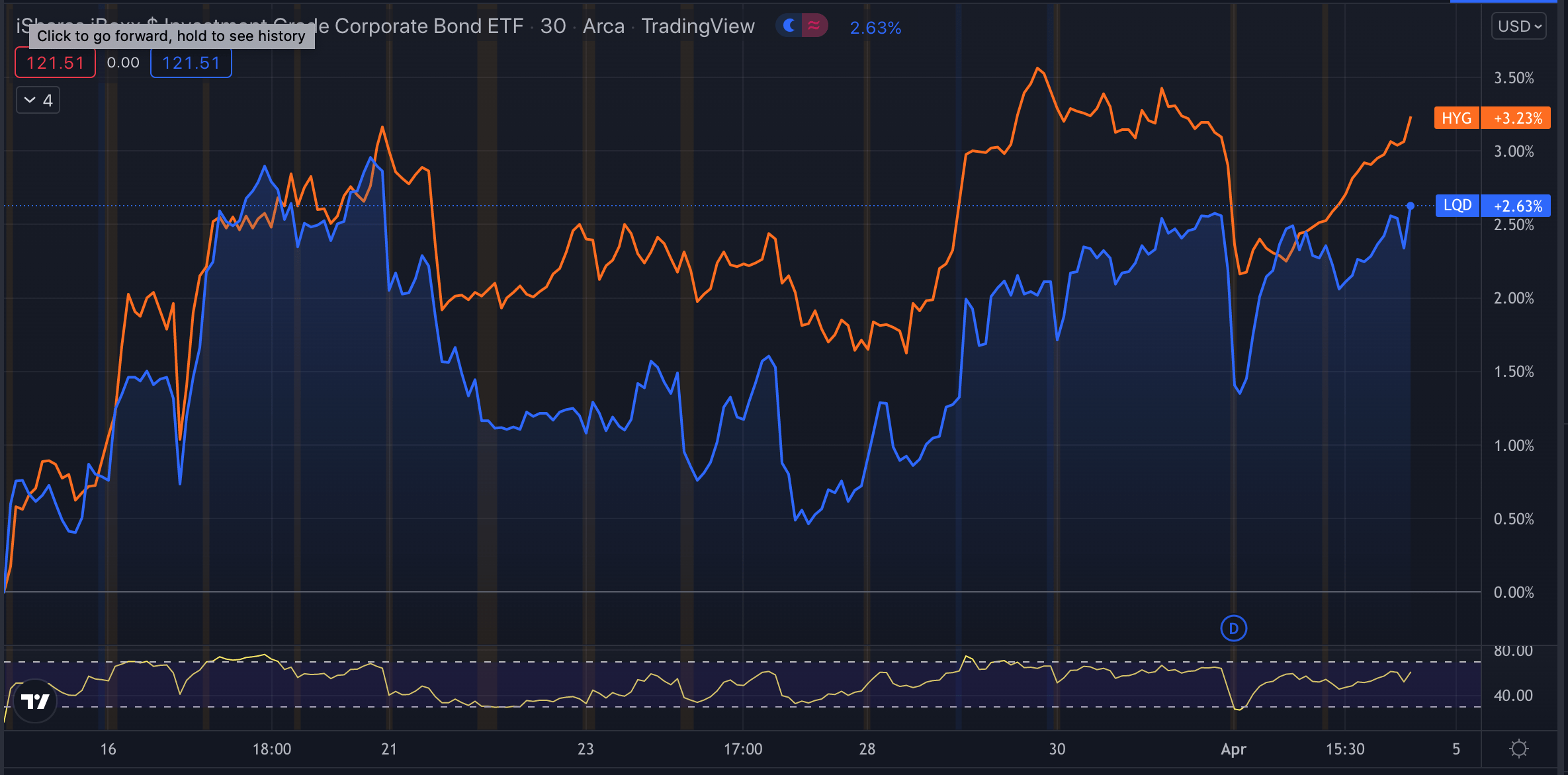

VIX is the lowest since mid-January. The spread between implied-realized vol is narrower, too, primarily due to realized vol catching up.

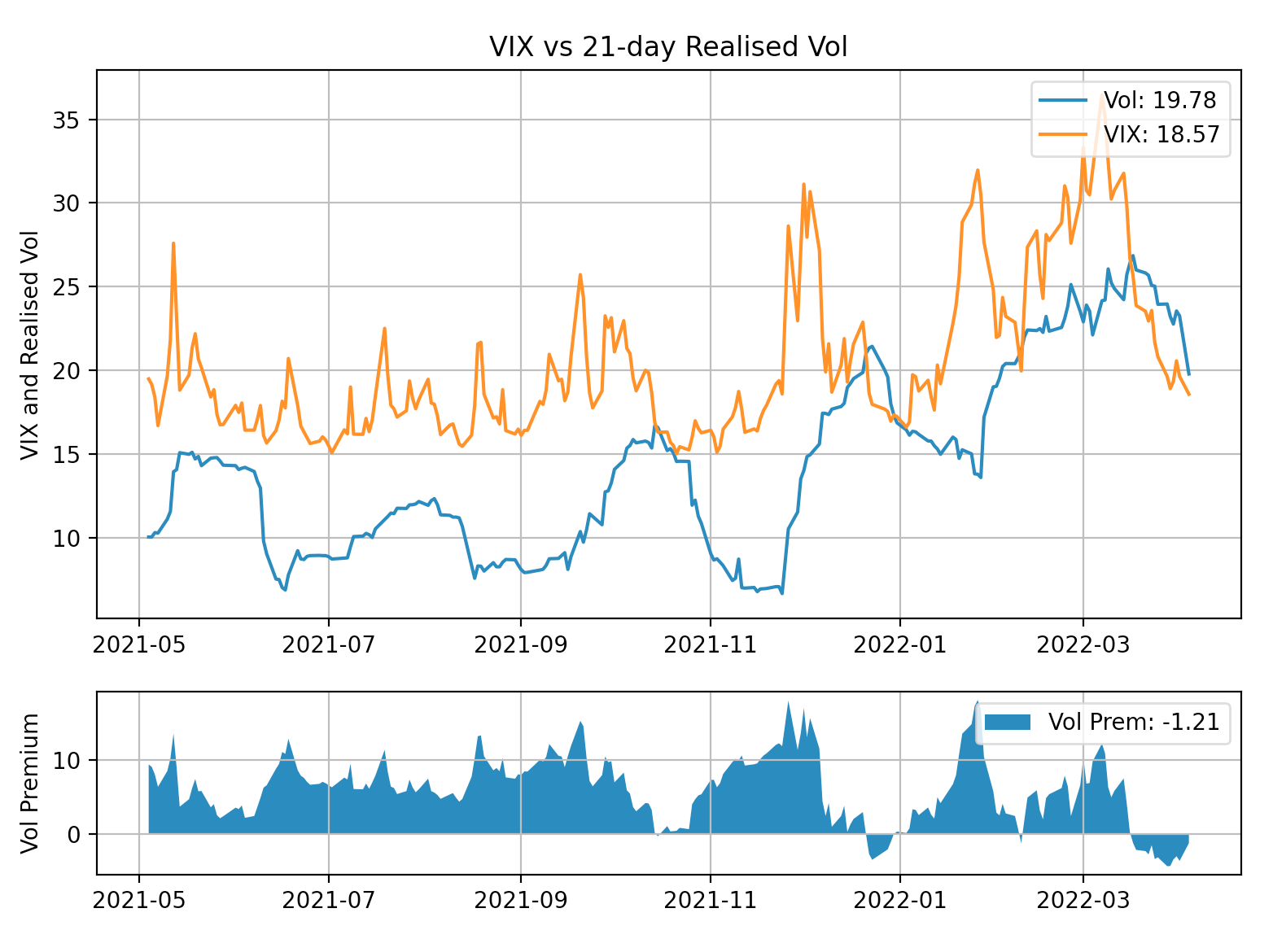

The gap against the European $VSTOXX is also closing, following the elevated uncertainty last month.

So what's not to like? "Everything is fine", as the famous dog once said.

The risk-on rally is going on despite a somewhat concerning macroeconomic backdrop.

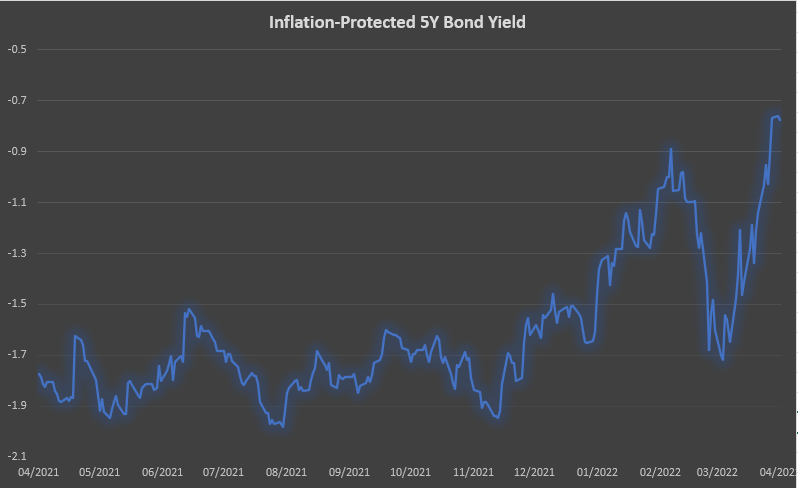

For a start, the bond market is flashing a big WARNING sign - real rates moving higher and yield curves inverted by all possible measures.

Real rates were stubbornly going up - first, this was driven by a rally in nominal yields last month and then by a drop in inflation expectations. Higher real yields mean higher debt servicing costs, higher discount rate for cashflows and lower demand for risk assets.

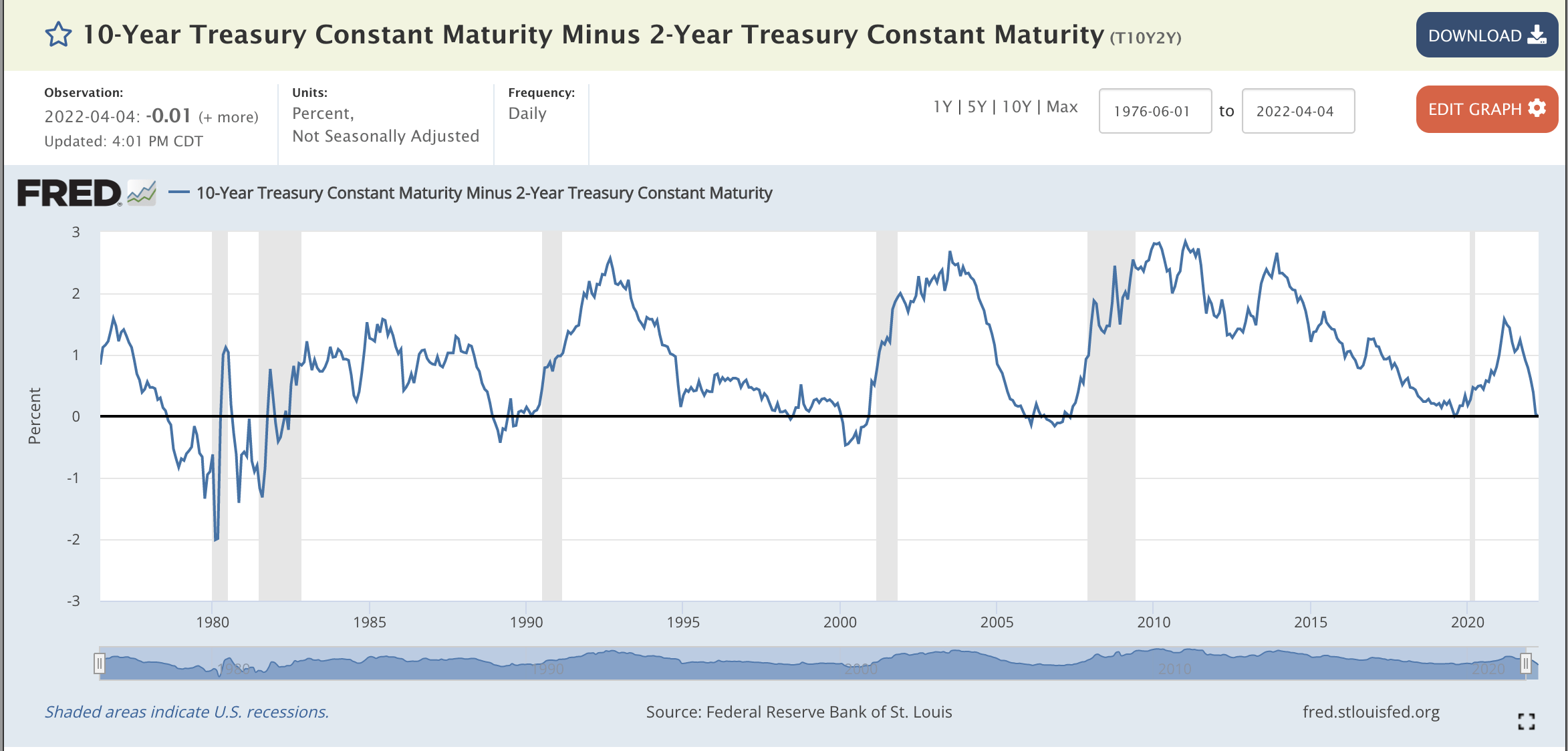

The Treasury 2s10s and 5s30s curves (and OIS swaps curves) are inverted - yet the Fed has hardly started hiking! The inversions have been a consistent predictor of recessions, hitting corporate earnings and valuations.

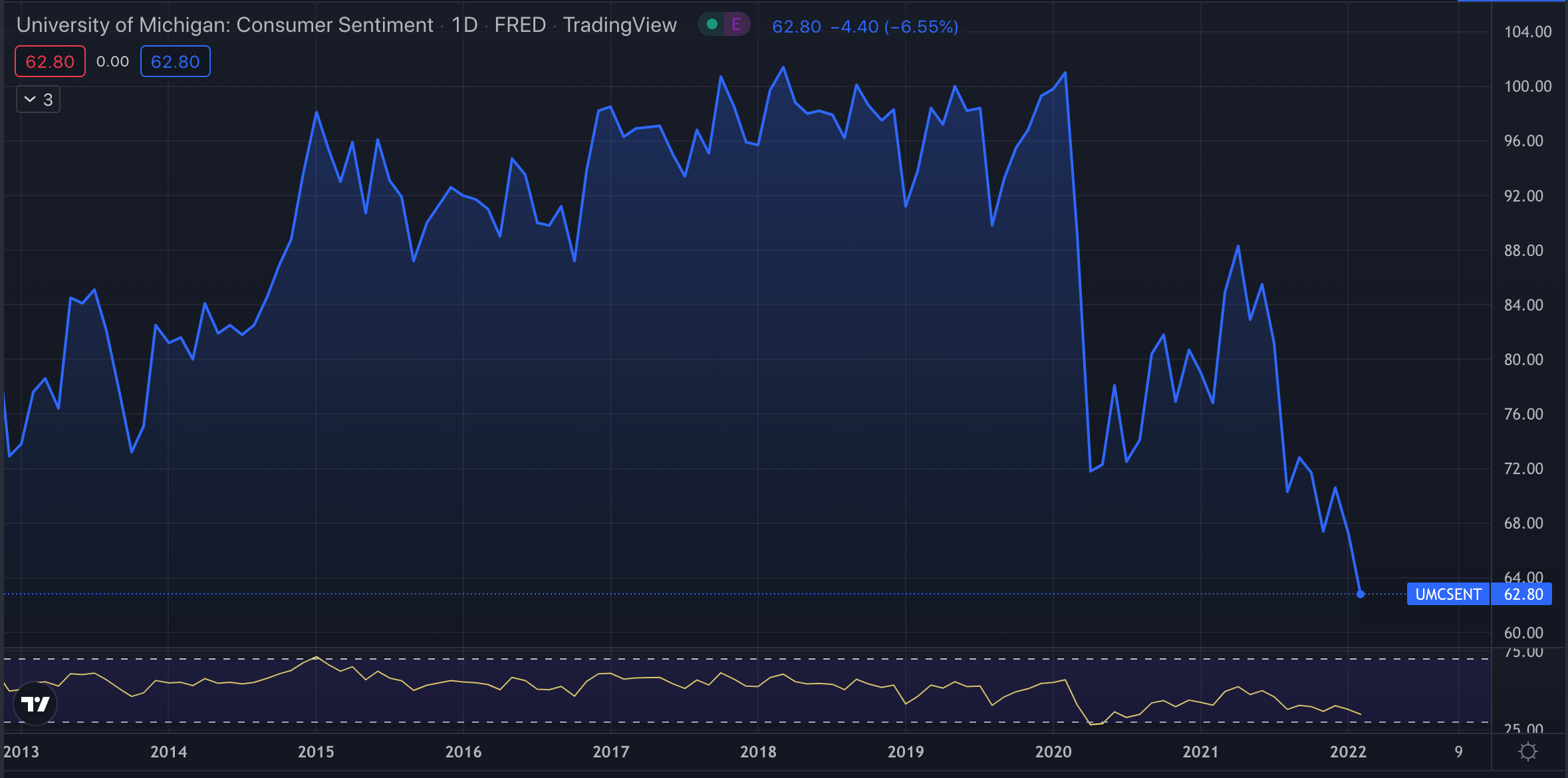

The Fed is yet to orchestrate a series of hikes this year, further reducing liquidity and tightening financial conditions. This is done against negative real wage growth, depleted Covid savings and the lowest consumer sentiment in a decade.

The war in Europe also adds to the risks and weighs on sentiment. Following recent developments in Bucha, there's little hope for substantial progress at the upcoming peace talks. Consequently, food and energy prices will stay elevated, putting more pressure on Mr Powell.

But the market seems to disregard all this and tries to stay positive (literary). With relatively more certainly around the war and Fed hikes, maybe there are reasons to remain bullish short term.

Just like in a car.

When the fuel light goes off, you still know you can go another 40 miles or so.

And the stock market is doing exactly that - the fuel is running low, but we can still do another hundred index points before the engine stalls, and the car breaks down.

As always, thank you for reading! For more posts, you can also follow me on Twitter.

Let's keep in touch! 🙂