Being a reserve currency is a blessing, but also a curse.

The mechanics are simple:

US Dollar is safe, secure, and stable

⬇️

People and institutions want to hold their savings and trade in USD

⬇️

Massive demand for US Dollar outside of US

⬇️

Dollar is stronger

⬇️

This allows the US to do two things:

- Use a strong USD to buy cheap imports

- Print USD without worrying about devaluing it

This sounds great initially, but that's only half of the story.

What is a Dutch disease?

Dutch disease occurs when a country suddenly experiences high demand for its exports - usually natural resources such as oil.

High demand for exports == high demand for currency

This causes its currency to strengthen, making it cheaper to import stuff, while exports get more expensive.

Its manufacturing and other industries can't compete with cheap imports and most go out of business.

Eventually, it leads to a situation when a country exports its natural resources and imports everything else.

Does US have Dutch disease?

Yes, but with one exception.

The demand for US dollar is driven by USD being a global trade and reserve currency.

The rest of the world wants to hold USD and use it to trade or to preserve capital.

This leads to a stronger dollar, which means:

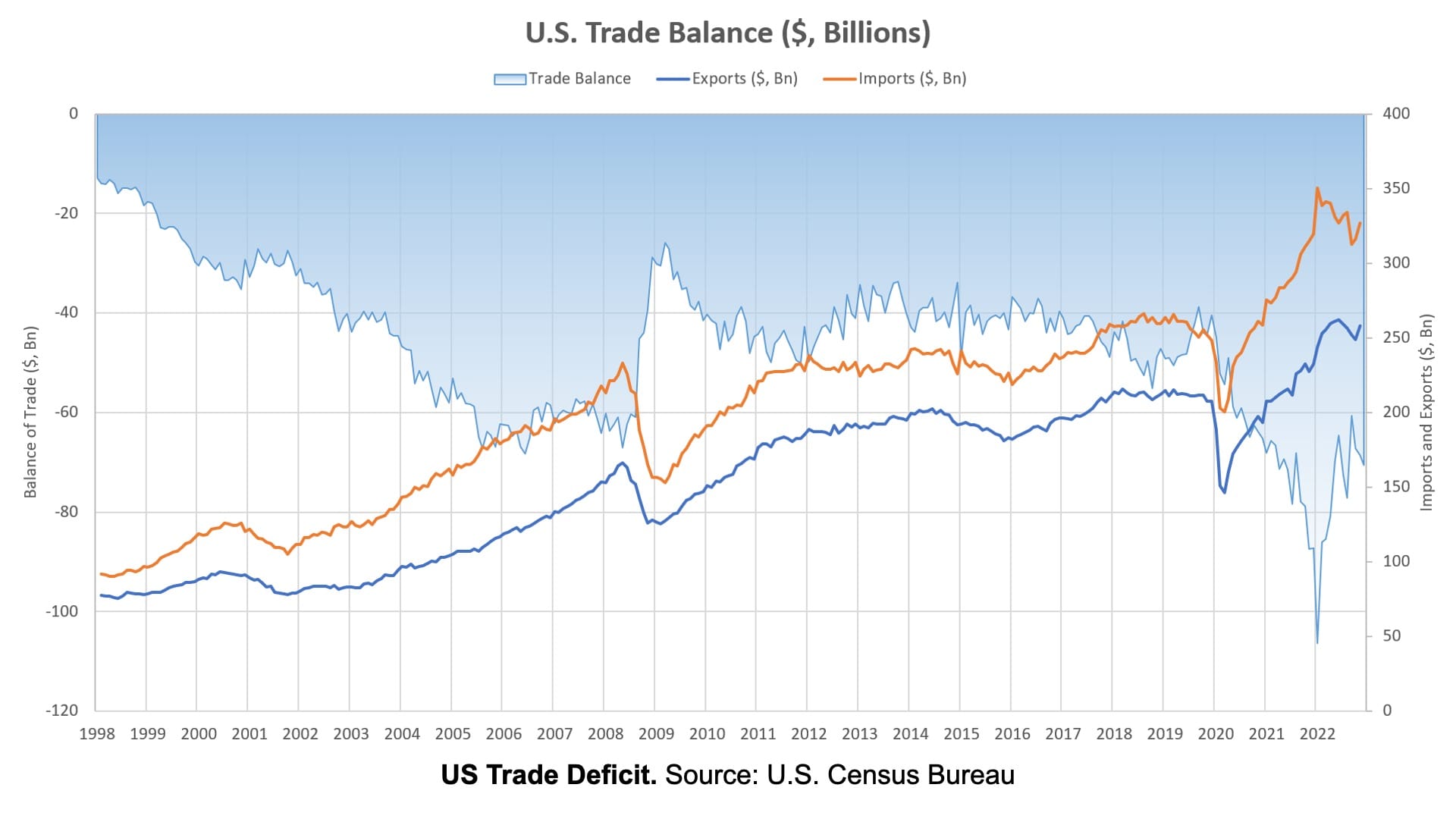

- US exports are expensive and uncompetitive on a global stage

- Imports are cheap and affordable

This results in a trade deficit, as the world is happy to sell its exports to the US in exchange for US dollars.

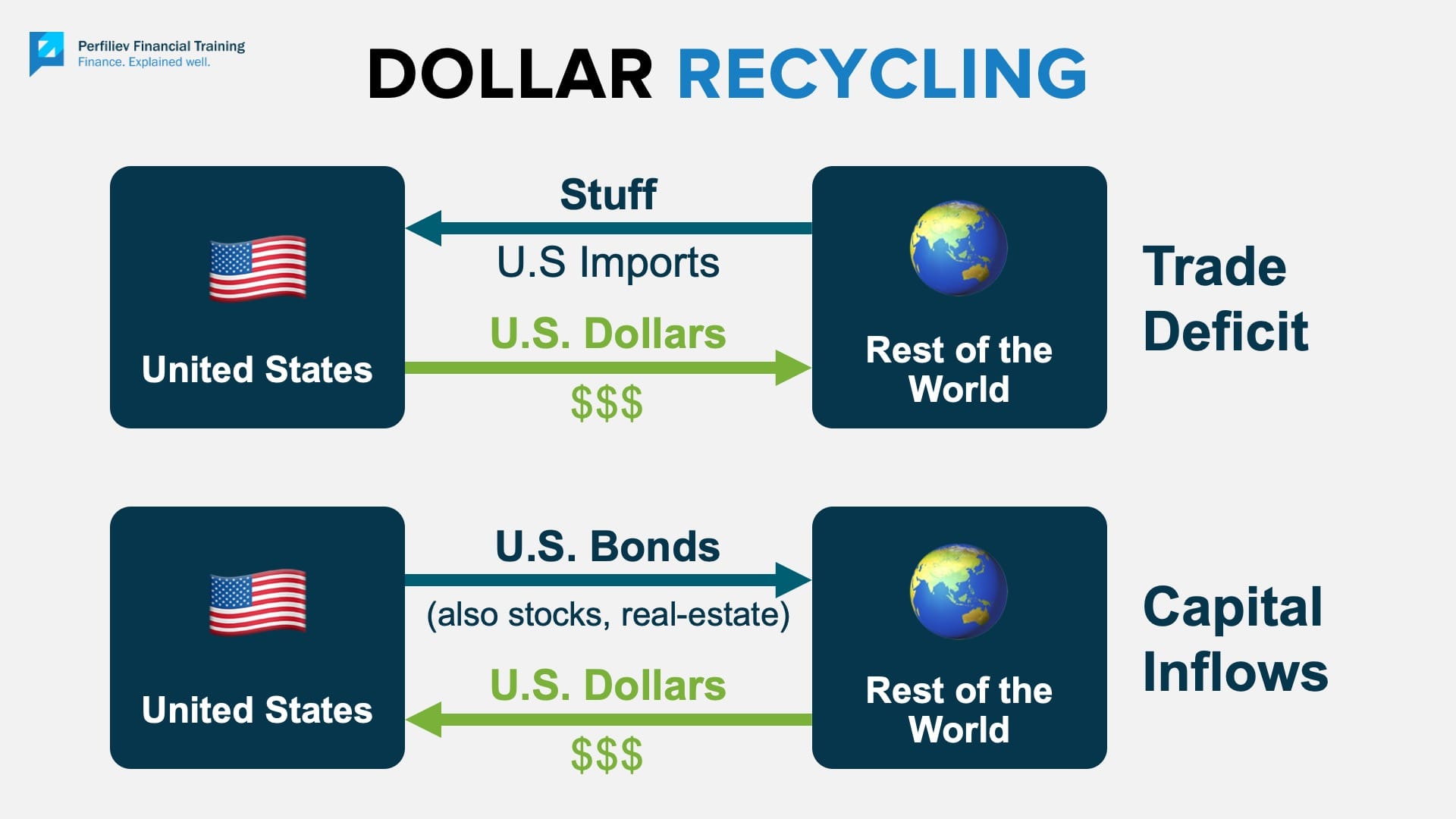

What is dollar recycling?

The rest of the world doesn't keep trillions of US dollars that it earns from trade as cash (it's impractical).

The best and safest way to store large amounts of currency is via bonds - i.e. US Treasuries.

This puts the US in a tricky situation, as it now sees a large demand for its debt too.

Where does US debt come from?

Budget deficits.

The US government can now run structural budget deficits, spending more than it collects in tax, financing the difference with debt, and selling it to foreigners.

The rest of the world is happy with this arrangement, as they have a way to store large quantities of their reserves in highly liquid and safe US bonds (i.e. the "reserve asset").

Hence, the US trade deficit is a feature, not a bug.

If you want to fix that, you'll need to untangle the whole economic system the world is based on. Good luck.