If you’ve been following the news this week, you’ve noticed that a Chinese real estate developer, Evergrande, has taken the main stage.

The company is reported to have around 300 billion dollars in liabilities that it is struggling to pay back.

Everyone is suddenly worried about Evergrande and its implications across the world.

But what are the implications? After all, isn’t Evergrande just one company? How much of an effect can it have on the Chinese and the world economy, if any?

In this post, we’ll have a look into what Evergrande is, why is it failing and what it means for the global economy, the markets and your portfolio.

What is Evergrande?

Evergrande is the real estate developer.

It was founded in 1996 and as recently as 2020 it reported revenues of $77 billion and net income of $9 billion.

It’s website states that Evergrande owns more than 1,300 development projects in more than 280 cities in China.

This makes it one of the largest real estate developers in the country.

So what exactly do they do?

Their business is to take a piece of land, construct a building on top of that and sell it on.

In order to do that, first they have to buy some empty fields of land – hopefully in a nice area with some infrastructure nearby, such that it will be desirable to live there after they’re done.

Then they need to buy or lease some machinery and equipment – all these trucks, cranes, tractors and such. All of that is converted into a construction site.

Then they hire some workers to operate the machines and build the properties.

Then, they also need to buy some materials to construct the building from – steel, sand, cement, concrete, glass and many other commodities.

Once they’ve got all that, they can start working. Slowly one by one.

They construct the ground floor. The first. Second.

And it usually can take a few years to get a fully refurbished building complete, as many of you know.

Why is this important?

Because, note that throughout all this process, the company still hasn’t got paid!

Once the building is complete, only then the company can sell the apartments and generate some revenue for all its efforts.

But before it does that, the company needs to hold a ton of inventory and equipment, which is why construction is extremely capital-intensive business.

This is also why real estate developers have very long cash conversion cycles – it takes years to build and sell an apartment building and get your money back.

So how do real estate developers pay for all these activities and materials?

One thing they commonly do is to sell unfinished properties to home buyers, who make a down payment or a deposit on an apartment that is yet to be built.

This practice helps real estate developers generate some revenue at the start and somewhat ease their financing requirements.

But unfortunately, it’s nowhere near enough to pay for all the equipment, labor and materials needed to build an apartment block.

Where does the rest of the financing come from?

Debt

They can borrow money from banks and investors and use the proceeds to finance their activities.

Of course, at some point in the future, they’ll need to return the loan.

How do they pay it back?

There are two ways available for real-estate developers to pay down their debts:

First option is to wait for the construction to complete, sell the property and use the proceeds to pay back the loans and the interest.

This method seems obvious; however, it greatly depends on the developer’s ability to sell the properties.

If the economy is doing well and there’s a healthy demand for real estate, it’s not a problem.

But what if the demand isn’t as strong by the time the construction is complete or the housing market hasn’t been growing as fast as was expected initially?

In that case the company can fall short on cash and will need to resort to another option to pay back the debt.

And that other option is - more debt!!!

In case the developer hasn’t generated sufficient revenues to cover existing debt payments, it can resort to banks and capital markets and issue more debt.

This new debt can be used to pay off the existing debt and potentially finance other vital business activities.

So yes, apparently, it’s possible to fix the “too much debt” problem with... more debt.

It’s like trying to cure a hangover by drinking more alcohol – yeah, it solves the immediate issue, but creates a few more problems down the line.

For example, what if now the company has difficulties repaying that new debt that it issued to repay the old one? Well, it can always issue even more debt and use that to pay back the creditors.

And it’s easy to see how this process can spiral out of control with ever increasing debt burden that becomes more and more difficult to repay without borrowing even more.

Chinese Real Estate Boom

When the economy is going well, both of these debt repayment options are available.

Fortunately for Evergrande, debt hasn’t been an issue until now, because the Chinese real-estate market was booming.

Demand for real estate has been extremely high, driven by a number of factors.

First – it’s the urbanization of China. As the Chinese economy grew, many have moved from rural areas and relocated to big cities in order to take advantage of better paid jobs and other opportunities.

Then, there’s also social pressure to own real-estate – mostly due to something called the “Hukou” system, which tracks permanent address registration of Chinese citizens and ties all kinds of social welfare and benefits to that address.

Lastly, increasing real-estate prices provided excellent investment opportunities, especially for a lack of better alternatives in China.

As the Chinese economy grew, for someone born in China, the best way to participate in this extraordinary economic expansion was by being invested in the real estate market.

You didn’t even need to rent it out – the property can stay vacant, appreciate in price and be sold for profit a few years later.

As a result, it’s estimated that Chinese have 78% of their wealth tied up in residential property, which has only pushed the prices further up (source).

And despite the huge construction efforts and a massive number of new properties that came on the market, the supply was still not enough to satisfy all the demand.

Some local governments even had to step in and limit the number of properties that a single household can own (source).

As a result of this real-estate investment boom, it is estimated that around 50 million apartments remained vacant (source).

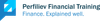

And unfortunately for Evergrande, the housing market eventually started to slow.

House prices weren’t growing at double digits as they used to and Evergrande’s profits started to take a hit.

More and more debt was needed to finance the current operations and to service existing debt payments.

The situation further worsened when Coronavirus lockdown hit in March 2020 and the economy came to a standstill.

This had an impact on supply chains and labor and new building development has slowed down significantly.

In 2021, Evergrande issued a profit warning (source).

Their costs and expenses have been growing year over year and it became more difficult to service its debt obligations.

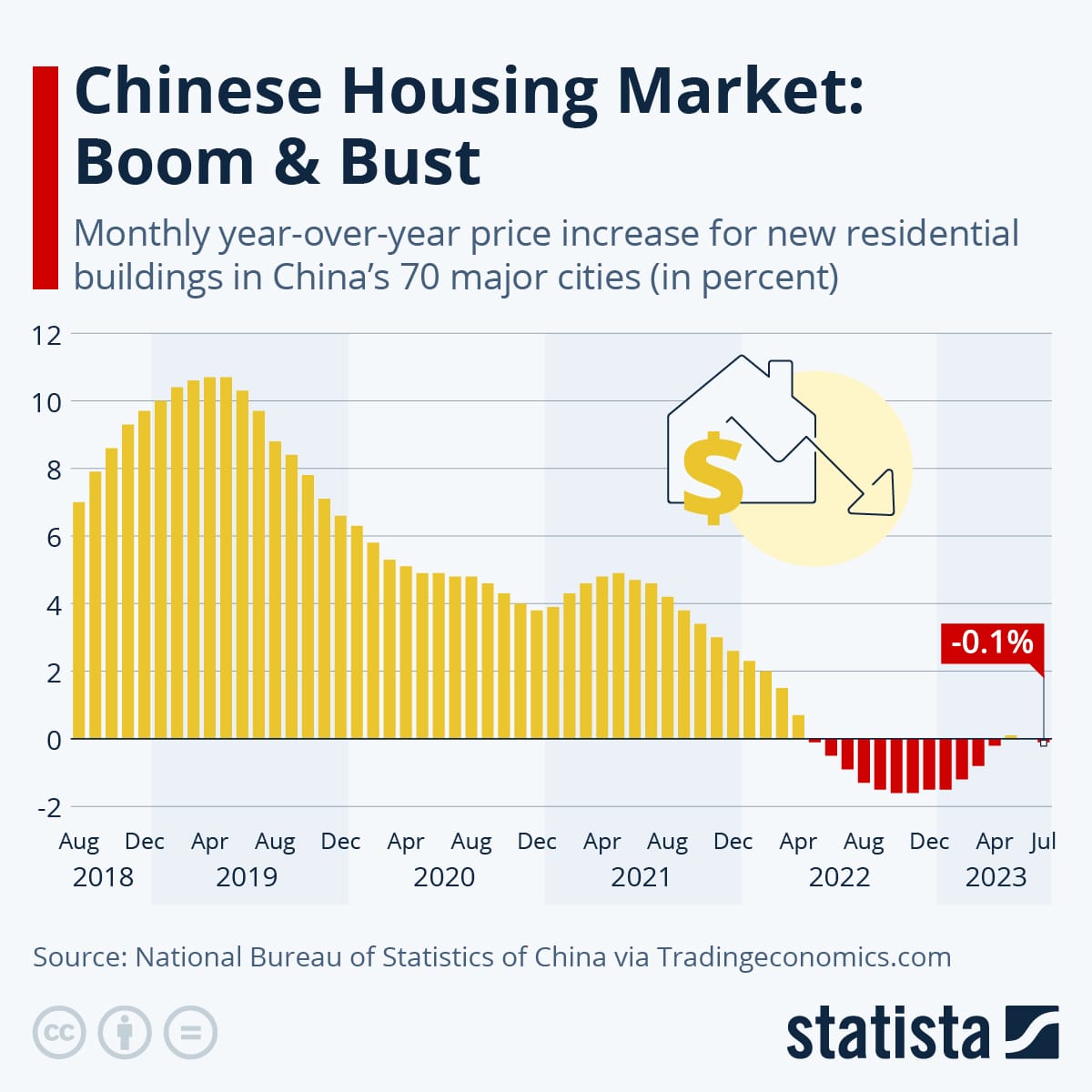

For example, next year in 2022, Evergrande has over 7.4 billion dollars of bond payments due (source).

It also didn’t take long for the stock market to take notice, as Evergrande share price has lost around 90% over the last 4 years.

Why is Evergrande failing?

At the beginning of this post, I’ve mentioned that a real estate developer such as Evergrande, has two options of repaying the debt – either from its profits or by issuing even more debt.

And given that Evergrande profits evaporated as quickly as Coronavirus cases in China, the only remaining option was to issue more debt.

Unsurprisingly, the market wasn’t particularly keen on lending to a struggling real estate developer, as the risk of not seeing your money ever again is considerably high.

And so, Evergrande found itself facing liquidity issues.

This simply means that a loss of confidence has occurred and Evergrande was struggling to find anyone who would lend them money.

After all, if someone was willing to do so, they could simply buy Evergrande bonds in the secondary market.

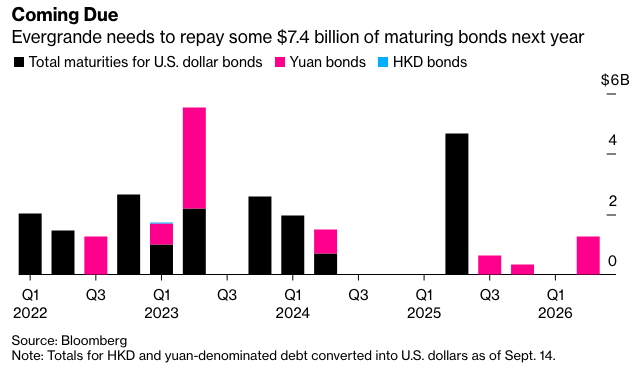

Many of their bonds were trading as low as 30% of their face value, meaning that if Evergrande were ever to pay them back, an investor would receive more than 3 times their initial investment.

For example, the yield on Evergrande’s 5-year bond has reached 560% in September 2021 (source).

If Evergrande were to issue new debt at that time, a 500% yield is approximately how much they would need to offer in order to entice creditors to lend them.

Hence, the company is effectively cut off from raising any further capital and from financing its activities.

As a result, Evergrande tried to borrow money from other sources.

For example, it is reported as of December 2020, that Evergrande received down payments from more than one and a half million home buyers, for apartments that are yet to be built.

It even managed to borrow money from its own employees, by blackmailing them that they won’t get their bonus payments (source).

So it’s not only the investors and creditors that will take a hit, but wider stakeholders as well, and that has implications for the economy as a whole.

If the confidence is not restored, the liquidity crisis can also evolve into a solvency crisis, when company’s assets drop below its liabilities.

In case Evergrande attempts to raise capital by liquidating their assets, it’s likely these assets will be sold rapidly and below market value.

Moreover, many of Evergrande’s assets are tied up in unfinished developments and half-built properties.

They would need to offer sufficient discounts for another developer to take them over. Especially if there’s a substantial risk of the housing market turning south.

Hence under a scenario of a fire-sale valuation, Evergrande’s assets might drop below their total liabilities and the company will become insolvent, which finally will make it attractive to wallstreetbets investors.

Evergrande Implications on the Chinese Economy

So why is everyone worried about that? If Evergrande fails, why does it matter?

Well, in case of a failure, the economic consequences might be catastrophic.

First of all, there’ll be direct loses by lenders, suppliers and homeowners who submitted a deposit for a yet-to-be-built property.

Evergrande also employs over 120,000 people who will lose their jobs.

However, it’s the loses by local lenders and banks that are of a particular concern, as they could spill over into the Chinese banking and financial system.

For example, in case one of the banks finds itself overexposed to Evergrande debt and is unable to pay on its deposits, this can cause a panic and result in a run-on-a-bank by a wider public.

If everyone starts withdrawing their money, this can cause problems for other banks, even if they were well capitalized.

And as we’ve seen in 2008, issues in the banking and financial sector can easily ripple throughout the economy, as lending drops, consumer spending drops, business activity drops and many find themselves out of jobs.

In addition to direct loses, Evergrande’s liquidation will potentially result in a quick-fire sale of existing portfolio of properties and inventory, causing declines in the housing market, which has been cooling down lately as it is.

That on its own is a big factor because a large proportion of the Chinese population are homeowners and real-estate investors.

Declines in property prices will impact the financial well-being of many Chinese families and inevitably have a negative impact on the Chinese consumer.

And less spending and less consumption leads to lower economic activity.

Lower house prices can also lead to lower real-estate demand as fewer households will be investing in properties.

Especially after seeing Evergrande customers lose their deposits and down payments on apartments that were never built.

This will cause even further declines both in prices and in real estate activity, which CNBC reports amounts to 30% of China GDP (source).

International Impact of Evergrande Crisis

So far, we’ve looked at how Evergrande’s bankruptcy might cause issues within the Chinese financial sector and the housing market, resulting in a slowdown of the overall Chinese economy.

But why should this matter for overseas residents and international investors?

First of all, China is the second largest economy in the world – they are a big market and a massive contributor to global GDP.

Many international companies export their products into China.

If China begins to import less goods, this will bleed into other regional and global markets and will negatively impact the revenues of many global exporting companies that rely on Chinese demand.

Secondly, China and the Chinese construction sector in particular, is a huge global consumer of commodities and raw materials.

A slower economy and a slump in a construction activity will result in a lower demand for commodity products, such as steel and Iron Ore.

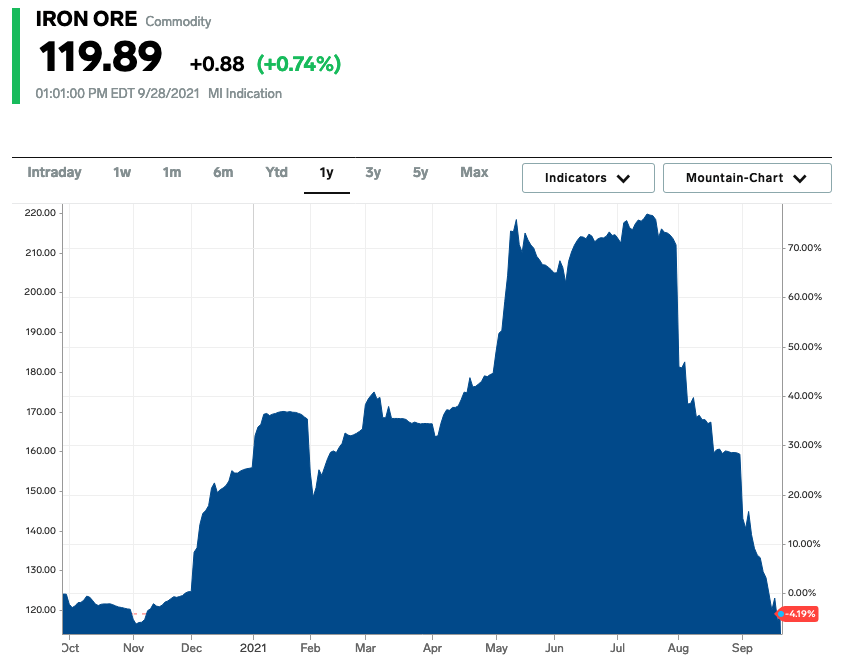

It’s not surprising that Iron Ore has been feeling unloved since July 2021 and Iron Ore prices were collapsing throughout the summer and into the autumn of 2021 (source).

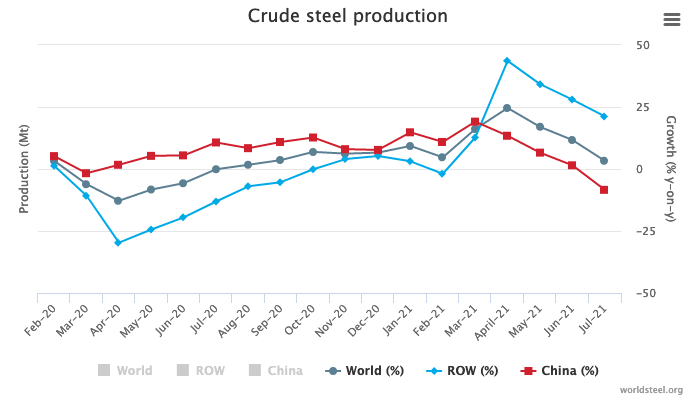

Steel production was also heading lower leading up to Evergrande’s crisis in September (source).

Lower commodity prices and weaker demand will have a direct impact on miners and other commodity producers, such as Rio Tinto, BHP and Anglo American.

Their share prices have also experienced declines in an anticipation of lower revenues and profits in the future.

Moreover, lower commodity prices will also have a knock-on effect on the economies and currencies of commodity exporting countries, such as Australia, Brazil, Canada, South Africa and many others.

And lastly, if the Chinese economy isn’t performing well, it’s assets won’t be performing well either.

As a result, international holders of Chinese equities and credit will start to incur losses on their holdings.

In the event of Evergrande’s liquidation, it’s also probable that onshore, yuan-denominated bonds would take priority over offshore, dollar denominated bonds, further hurting overseas creditors.

Potential Solutions to Evergrande Debt Crisis

So what can the Chinese government do about the Evergrande situation?

First, let’s look at the two obvious solutions, neither of which are particularly appealing for the Chinese Communist Party.

First one – it can let it fail.

This will serve as a good lesson to other property developers in China and encourage them to use better risk management with their business practices.

But unfortunately, a bankruptcy event can potentially spill over into all these issues that we’ve discussed earlier.

And, ultimately, the Chinese government wants to avoid these issues.

The other option is to bail Evergrande out.

The government can make guarantees on their loans and offer further financing, potentially in return for a stake in the company.

In other words, it can become a lender of last resort, which would solve Evergrande’s liquidity crisis.

However, this scenario raises an issue of moral hazard.

A bail out can encourage even more irresponsible borrowing among other Chinese companies.

Since they will be confident that the state will always bail them out, should they run into financial difficulties.

And this isn’t something the Chinese government wants to promote, especially considering their earlier policies aimed at reducing corporate leverage.

So, are there any other options available, apart from letting it fail or bailing them out?

Of course. There are also many other intermediary solutions, some of which rely on government intervention.

For example, there can be a case of debt restructuring – the company can work with creditors and try to renegotiate new terms for its debt payments and hopefully push out the maturities.

To help with this process, Evergrande can also decide to selectively fail on international payments, but honor the domestic liabilities.

If debt restructuring doesn’t bear fruit, then Evergrande itself could be restructured and dissolved into smaller and more manageable businesses.

Alternatively, the government might also decide to do a managed demolition of Evergrande in order to limit any possible contagion into its financial system or the housing market.

In all these scenarios, the key question is – who gets paid first?

If the government gets involved, it might be that the usual rules of claim seniority do not apply.

In this case, it’s not immediately clear who gets paid and who goes home empty handed.

Which one of these scenarios will happen in the future? Well, we’ll have to wait and see.

Thank you so much for taking the time to read this! I sincerely hope you found it interesting and valuable.

Follow me on Twitter (https://twitter.com/perfiliev) for more educational threads around stocks, options and other topics within the incredible world of financial markets.